Work with a Fiduciary

Financial Advisor

Your search for who can help you manage your business finances and personal finances has led you here.

We believe you deserve to know exactly what your money can do for you. No one should be left wondering if they’re doing enough financially to secure their future. As an entrepreneur myself, I completely understand how managing a business and having a family at the same time creates little margin for self care, including your money. This is where my 30+ years of experience of building a practice based on my clients’ needs during your accumulation as well as your distribution years has helped so many people just like you.

Work with a Fiduciary Financial Advisor

Your search for who can help you manage your business finances and personal finances has led you here.

We believe you deserve to know exactly what your money can do for you. No one should be left wondering if they’re doing enough financially to secure their future. As an entrepreneur myself, I completely understand how managing a business and having a family at the same time creates little margin for self care, including your money. This is where my 30+ years of experience of building a practice based on my clients’ needs during your accumulation as well as your distribution years has helped so many people just like you.

This is how we do it:

Our “Plan First” Approach

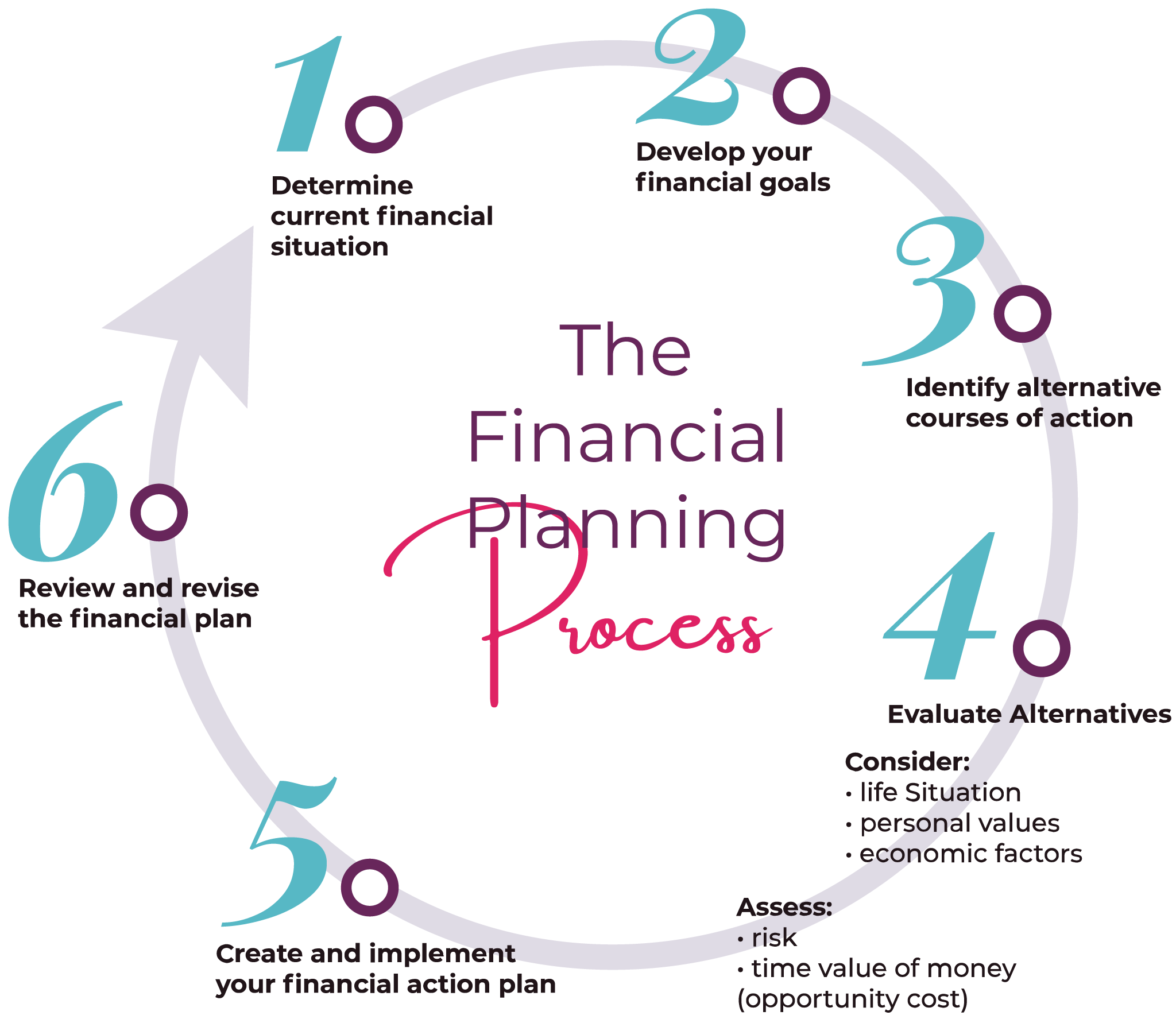

In order to make plans for tomorrow, you have to know where you stand today. That’s why we Plan First, Then Invest.

Your financial plan is more than just a road map that tells you how to get from where you are today to where you want to be tomorrow. And developing your individual plan isn’t just a one-time event. It’s an ongoing process where we help you discover, define and refine your goals and dreams.

Our comprehensive planning process organizes your financial life and divides your assets into two buckets: one for the short term and one for the long term. By making sure your short-term liquidity and income needs are met, we can then make investment decisions that support your long-term goals.

1

College education funding

2

Protect current level of wealth

3

Leave an estate for heirs

4

Charitable giving

5

Minimize income and capital gains taxes

6

Improve household cash flow

7

Better manage market risk

8

Maximize tax benefits for individuals and businesses

Stop feeling like you’re falling short of what you want and instead have a clear financial vision for accomplishing everything you ever dreamed.

Getting on the right track with your personal and business finances starts with a decision to take action

Download the 3 Habits of Highly Successful Business Owners and start today.

The first step to achieve true financial success is getting organized. By discovering the best habits that really work for successful and wealthy people, you will be halfway there. In 3 Habits of Highly Successful Business Owners, you will learn:

- How much they save on their Income and why.

- An Effective Risk Management Checklist.

- Who helps them to accomplish their most desired financial goals.

- How to get on the right track with your personal and business finances.